Blogs

I receive settlement in the services and products said within tale, however the feedback is the author’s very own. Learn more about how exactly we benefit and all of our editorial formula. Use the supplier or percentage mediator info because the found within the confirmation text message otherwise to your cellular phone expenses. Merchants or percentage intermediaries has 10 days to answer their inquire, very please let them have time and energy to care for they.

Investing together with your Android device

You can even put loyalty system notes to help you Samsung Spend so you can conveniently accrue perks. Banking characteristics provided with Community Government Savings Bank, Associate FDIC. Adam Luehrs is actually a writer throughout the day and you can a voracious audience later in the day.

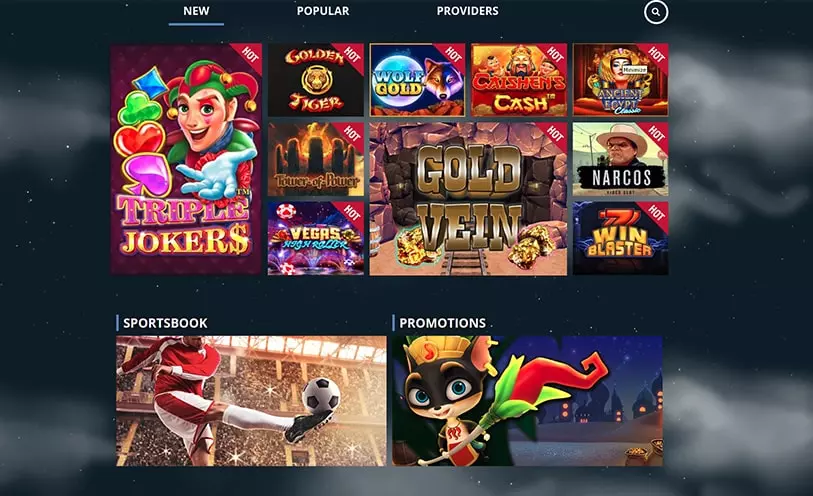

Get the Preferred Local casino Destinations away from 2024

Here i’ve searched a few cons of doing so when wagering with betting sites one to accept cellular phone costs. Gamblers should understand that there are many different charges to possess mobile phone bill playing and therefore are very different heavily away from services to help you provider. Specific web sites usually charge for both a deposit as well as a good withdrawal, which means that while you are using through cellular telephone expenses is fantastic for postponing your bet, it may be a little high priced. Fool around with common sense, but not, when making a fees otherwise transferring currency. Definitely’lso are utilizing the right method for the new payment.

A statement spend services can be provided within a good examining account’s provides. The newest Wells Fargo Autograph℠ Cards is a wonderful no annual percentage card that offers 3x issues to your six some other extra categories. Texting micropayment is when you purchase a product from a vendor by delivering a minumum of one texts out of your mobile cellular telephone. The merchant or percentage seller following provides you with a 5-digit number.

You now have completed tying your money to help you WeChat Shell out and they are today willing to make fully secure on the internet transactions. For those who have a radio account, you can take a look to enroll within the TXT-2-Pay making use of your tablet or computer. This really is a free of charge-of-charges services you to definitely texts your your cordless balance half dozen weeks just before it is owed. After you have this service establish, you could pay your expenses with your chosen percentage approach merely by the addressing the text message. You could find the fee agenda and the amount you need to spend. And have the ability to install you to-day otherwise continual costs.

Don’t worry should your financial or borrowing union doesn’t provide Zelle but really – you can down load and make use of https://prime-betz.com/en-au/ the newest Zelle app until they actually do. We now have in addition to remaining an eye on any will cost you associated with the new greatest mobile fee apps. Earliest informal transactions simply need you to have an easy-but-effective app, however, if you’re looking for a lot more capabilities, the brand new repaid-to own alternatives would be worth a look. We have searched the importance for money element of people included right here.

An installment strategy is’t become its a fantastic unless it’s got a great customer care party sat on the subs bench in order to look after any issues you’re also having. We always outline several enquiries to get an end up being for how amicable and really-informed per support team are. All you need to do to make use of this provider is see Payforit when you attend deposit currency.

If you don’t get mobile phone to you however you still have to shell out your statement, it can be done online with your computer system or any other device. On the web gaming has exploded the number of available options and you will sportsbooks provides chance, lines, and much more from the game. The chances quickly changes according to the proceedings regarding the video game and you can gamblers have to make quick conclusion.

Check out the My Check out tab and you may faucet to your Handbag & Apple Spend choice. This may offer their wearable a similar energy as your actual card, you’ll have the ability to shell out with your smartwatch whether or not your new iphone 4 isn’t nearby. Just as in Fruit Spend and you can Google Shell out, you can use Samsung Spend in your Universe cellular telephone otherwise observe anyplace you see the new contactless commission signal, through NFC. Samsung Spend in fact happens then even if, and now have supports the brand new older magnetic stripe terminals where you do generally swipe a credit.

The payee decides the amount of time their expenses detail try readily available. The length of time the costs detail can be acquired selections of per month in order to six months. If you don’t receive your first statement electronically, you need to continue to spend one costs you can get through the mail. Sometimes you will begin acquiring electronic expenses immediately after you will get see that the fresh activation consult succeeded.

You could pay along with your checking account, debit or charge card otherwise, in a few parts, an automatic teller machine cards otherwise money market membership. This really is a alternative when you are quickly otherwise alongside their bill due date, because your commission was inserted from the CenturyLink solutions on the a similar time. Sign in back at my CenturyLink to gain access to their debts, pay your bills, set up AutoPay, create paperless billing, and save your commission guidance to possess coming one to-go out payments. You might shell out that have borrowing from the bank otherwise debit card, or bank-account within my CenturyLink.

The risks for the payment means resemble those your bring having on the web bill shell out, whilst you have less control of the brand new fee time that have ACH debit repayments. While you are unusual, payees could possibly get affect take too much or eliminate financing in the an excellent bad day (if the account is actually blank, including), causing overdraft charges. Let’s view simple tips to shell out your bank card, when to pay the mastercard expenses and just how you can choose an informed bank card percentage alternatives for their a lot of time-label monetary requirements. Shell out along with your family savings for no fee or make use of your debit otherwise charge card for an excellent $dos.65 comfort percentage.

Delight make sure to read the payee’s terms and conditions meticulously whenever offered. Possibly deciding on discover an internet bill implies that their report bills would be deterred, but this should be stated in the new payee’s small print. When you turn on eBills, you could potentially like to pay you to eBill yourself otherwise create automatic payments. Electronic costs (eBills) is actually online versions out of papers expenses that you receive, consider, and you may pay as a result of Costs Spend. Though it may look other, all of the information from your papers statement are exhibited online, plus the frequency of your bill continues to be the exact same.

Speaking of all of our picks to discover the best credit cards to have residential take a trip. You’ll discover that for each card has its own unique band of advantages. You might be wanting to know if a charge card’s cellular telephone publicity may be worth making use of. This can be specially when compared to the a supplier’s elective insurance coverage. In case your mobile phone try stolen or broken, you’ll have to file a declare within this 60 days of one’s experience. To prevent allege assertion, you’ll must also give all required documents on the cellular telephone, incident, etcetera. in this ninety days.